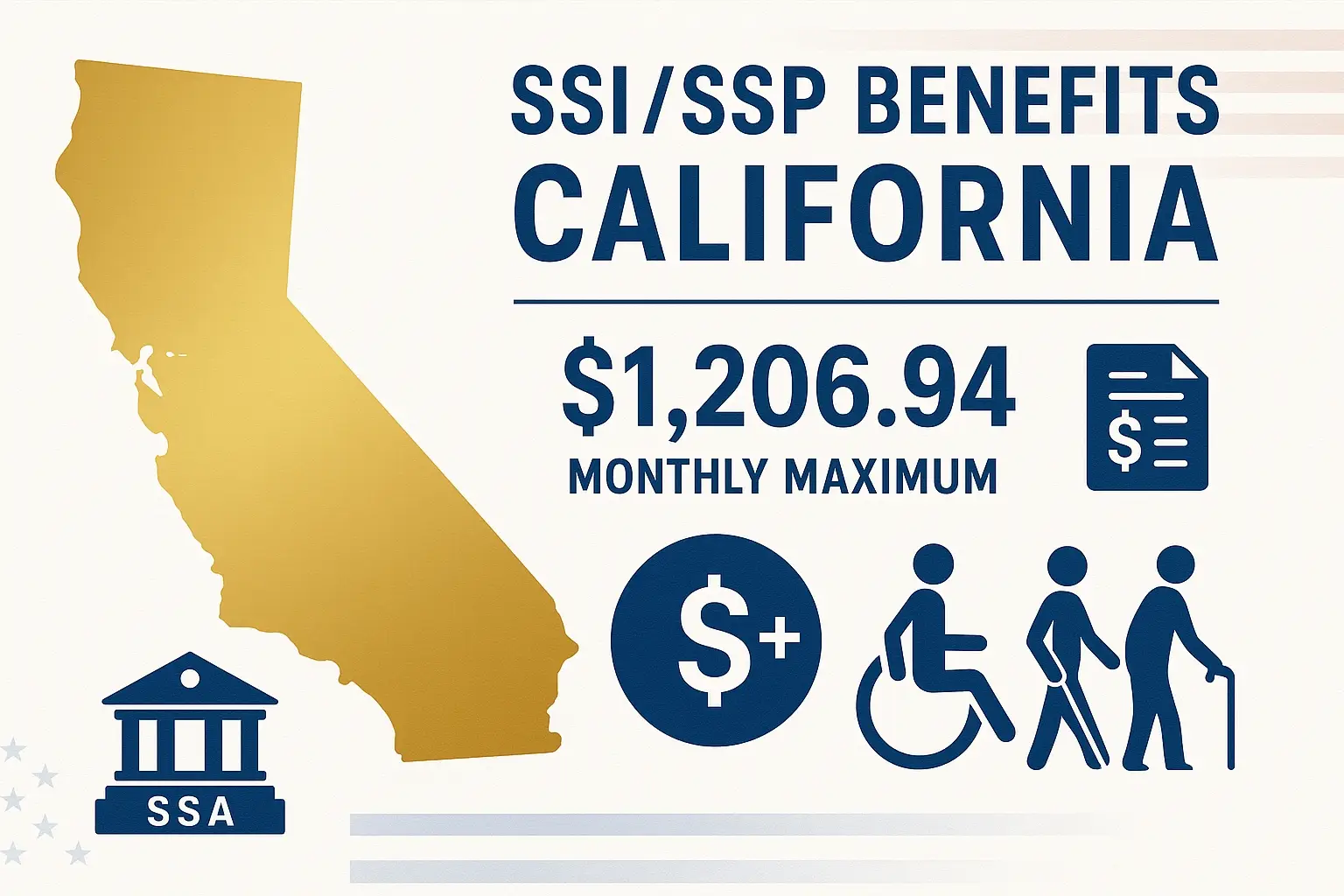

Over 1.2 million Californians receive monthly SSI state supplements, combining federal Supplemental Security Income (SSI) with California’s State Supplementary Payment (SSP) program. These combined payments are designed to help aged adults, blind individuals, and those with qualifying disabilities meet their basic needs—but only if they meet strict eligibility requirements and apply correctly.

The Social Security Administration (SSA) administers the federal SSI program and California’s SSP, issuing one monthly payment reflecting both amounts. This streamlined process ensures every SSI recipient in California receives the highest possible monthly benefit for their situation. Whether you are an eligible individual living independently, an eligible couple, or living in someone else's household, your state supplement payments are calculated based on your living arrangements, countable income, and resources.

Acting quickly is essential. Filing early and electronically reduces processing times, sets up direct deposit faster, and helps you avoid common mistakes that lead to delayed SSI payments or missed cash benefits. Waiting too long or submitting incorrect information can result in months-long delays and lost income. This guide will walk you through everything you need to know about SSI state supplements in California—from understanding the program and eligibility criteria to reviewing 2025 benefit amounts—so you can protect your income and get the support you deserve.

What Are SSI State Supplements in California?

California offers one of the most generous state supplements in the nation through its SSI/SSP program. At its core, Supplemental Security Income (SSI) is a federal program that provides monthly payments to people aged, blind, or disabled with limited income and countable resources. California enhances this support with the State Supplementary Payment (SSP), adding extra funds to help cover basic needs like food, clothing, and shelter. Both SSI and SSP benefits are administered by the Social Security Administration (SSA), which means recipients receive a single monthly benefit that includes both the federal amount (known as the federal benefit rate) and the California state supplement.

The combined benefit helps an eligible individual or eligible couple maintain stability when they cannot work due to age, blindness, or a medically determinable physical or mental impairment. For many people, these payments are the primary source of income, making them critical for housing, food security, and health care costs. California also adjusts its supplement to reflect cost-of-living changes, helping payments keep pace with rising expenses. Understanding SSI state supplements in California is essential for anyone planning to apply for benefits. Knowing how the SSI program works, who qualifies, and what the total benefit might be ensures you receive every dollar you are entitled to—without costly delays.

Eligibility Requirements for SSI and SSP

Qualifying for SSI state supplements in California begins with meeting federal SSI eligibility rules. California applies the same standards but adds a residency requirement to receive SSP. You can receive federal and state payments in one monthly benefit if you meet these criteria.

Age, Disability, and Blindness Criteria

You may qualify if you meet at least one of these conditions:

- The individual is 65 or older and unable to earn enough income to meet basic needs.

- The term "blindness" is defined by the Social Security Administration (SSA).

- A physical or mental impairment that is medically determinable and causes severe functional limitations, which include the following:

- The condition prevents substantial gainful activity (work).

- Has lasted or is expected to last at least 12 months, or result in death.

- The condition prevents substantial gainful activity (work).

- Children with qualifying impairments may also be considered eligible individuals.

Income and Resource Limits

To remain eligible for SSI, you must have limited income and countable resources:

- Resource limits: $2,000 for an individual, $3,000 for an eligible couple.

- Countable income: Includes earned income (wages, self-employment) and unearned income (pensions, other benefits).

- Exclusions: Your primary home, one vehicle, and burial plots are excluded as personal property.

- Deductions: Impairment-related work expenses (IRWE) can lower your countable earned income, allowing some applicants with part-time work to keep benefits.

Citizenship and Residency Requirements

You must also meet citizenship and residency standards:

- Be a U.S. citizen or qualified alien with lawfully admitted permanent residence.

- Certain groups are eligible: American Indians born in Canada, Afghan special immigrants, and residents of the Northern Mariana Islands, the Federated States, or the Marshall Islands.

- You must live in California to receive state supplement payments.

- People in a public institution qualify only under specific exceptions.

2025 SSI/SSP Payment Amounts

The amount you receive from SSI state supplements in California depends on your living arrangements, countable income, and whether you are an eligible individual or part of an eligible couple. The combined monthly benefit includes the federal Supplemental Security Income (SSI) amount and the California State Supplementary Payment (SSP).

Single and Couple Payment Levels

Here are the 2025 monthly benefit amounts for Californians who qualify for SSI/SSP:

These monthly benefits help cover basic needs like food and shelter. The state supplement ensures Californians receive more than the federal benefit amount, helping them keep up with high living costs.

How Countable Income Affects Your Benefit

Your total benefit is reduced if you have countable income. The Social Security Administration (SSA) subtracts part of your earned and unearned income from the federal benefit rate before adding the state supplement.

Example Calculation:

Federal Benefit Rate (Single): $943.00

State Supplement (Single): $263.94

Total: $1,206.94

If you have $50 of countable income, your benefit is reduced to $1,156.94 for that month. Reporting changes on time is crucial. Failure to report income can cause overpayments and penalties, while underreporting may delay future SSI payments.

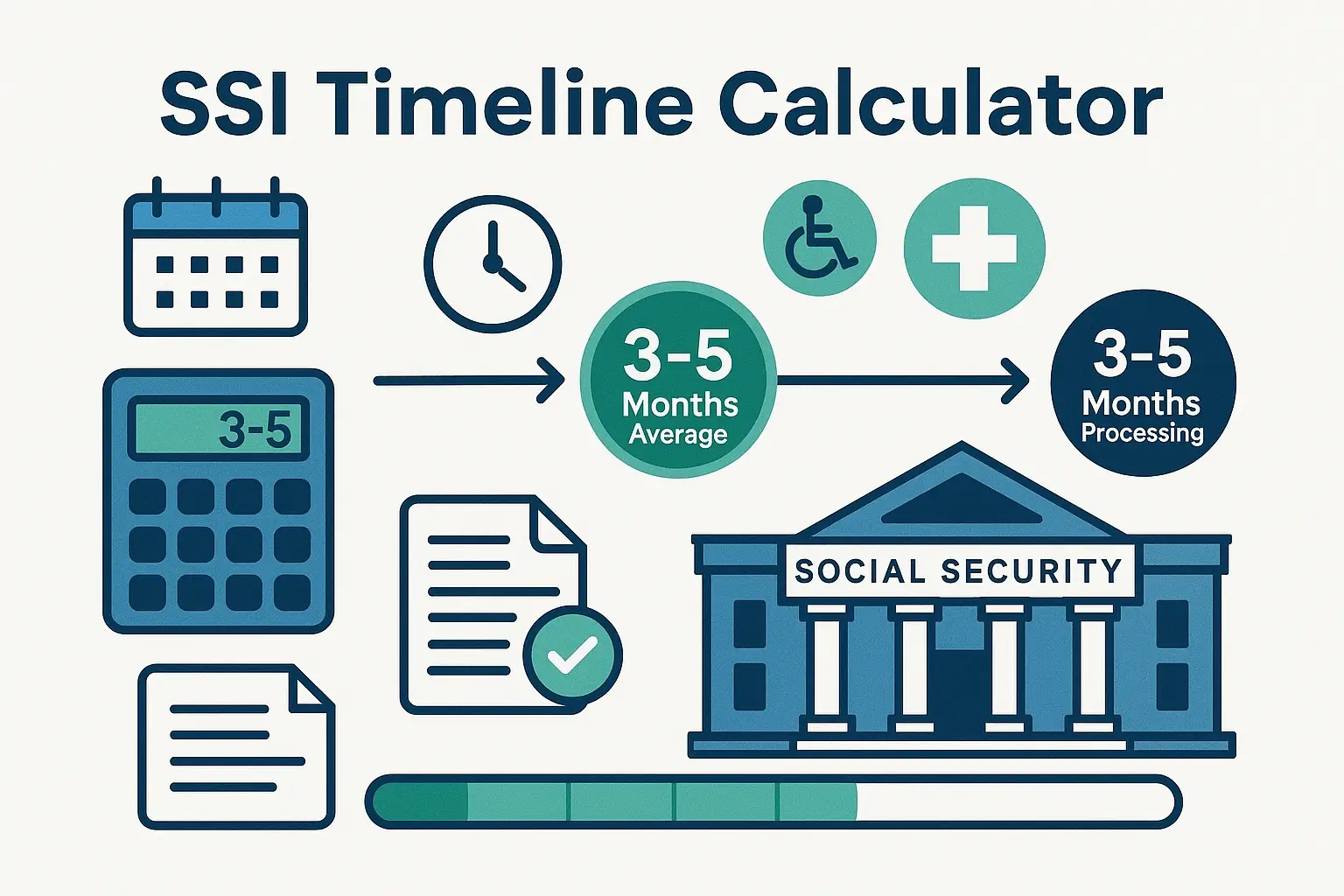

Application Process and Timeline

Applying for SSI state supplements in California is straightforward but requires careful attention to detail. The Social Security Administration (SSA) handles applications for both the federal SSI program and California’s SSP benefits, which means you only need to apply once to receive both payments.

Where to Apply

You can start your application in several ways:

- Visit a Local SSA Office: Schedule an appointment to submit forms in person.

- Apply Online: Go to SSA.gov to complete your application electronically, which speeds processing.

- Call SSA: Contact 1-800-772-1213 (TTY 1-800-325-0778) to begin your claim by phone.

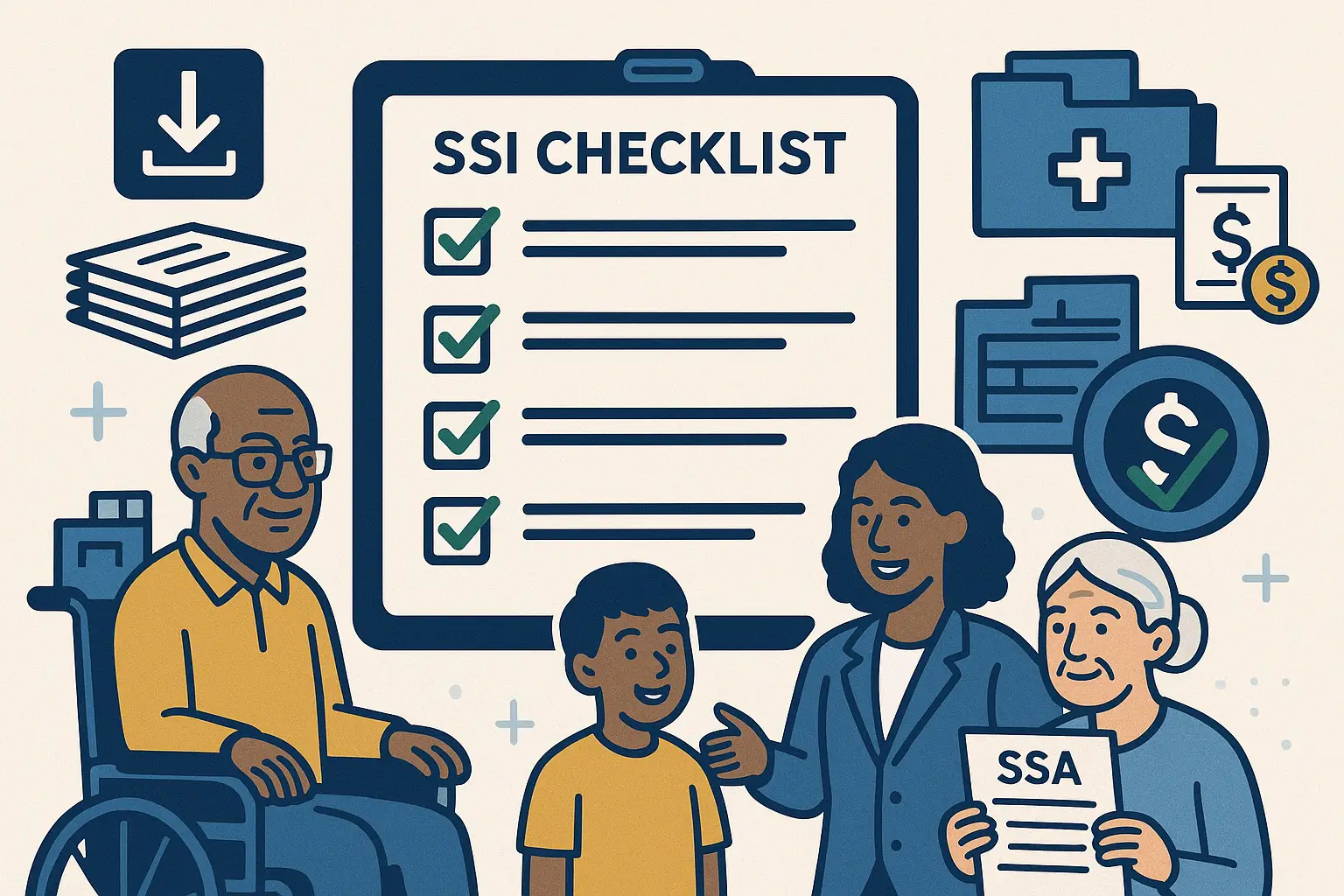

Required Documentation

Gathering crucial financial documents early helps avoid processing delays:

- Social Security card or record of your SSN

- Birth certificate or proof of age

- Proof of living arrangement (mortgage, lease, or landlord statement)

- Bank statements, payroll slips, insurance policies, and resource information

- Medical records if applying based on a medical condition

Timeline

Most applications take 3–5 months if medical evidence is required, while age-based claims may be processed faster if all documentation is complete. Filing electronically can cut weeks off the process and set up direct deposit for faster SSI payments. Apply as soon as you meet the eligibility requirements. Waiting to file could cost you hundreds in missed benefits, as payments typically start the month after your application is filed.

Related Programs and Additional Benefits

Qualifying for SSI state supplements in California may also make you eligible for other valuable programs that can reduce living costs and provide essential services.

- Medi-Cal: Most SSI/SSP recipients automatically qualify for Medi-Cal, California’s Medicaid program. Medi-Cal covers doctor visits, hospital care, prescription medications, mental health services, and preventive care. No separate application is required if you already receive SSI benefits, making accessing crucial health care for your medical condition easier without extra paperwork.

- CalFresh: You may qualify for CalFresh benefits (California’s version of SNAP) if you receive or apply for SSI. These supplemental payments help buy groceries and meet basic needs. Applications can be submitted at your local Social Security or county social services office, keeping the process convenient and connected.

- CAPI (Cash Assistance Program for Immigrants): For non-citizens who are lawfully residing in California but ineligible for SSI due to immigration status, the Cash Assistance Program for Immigrants (CAPI) offers similar cash benefits. CAPI follows the same eligibility criteria and countable income rules as SSI, ensuring support for qualified individuals with limited income.

- County-Level Services: Counties may provide additional help, such as in-home support, mental health services, or personal care assistance for people with severe functional limitations. Contact your local government or county social services office for available programs and referrals to other benefits.

Common Mistakes That Delay or Reduce Benefits

Even if you meet the eligibility requirements for SSI state supplements in California, inevitable mistakes can reduce your benefit amount or delay payments. Being proactive can save you time, money, and stress.

Avoiding these easily preventable errors can help ensure your SSI payments arrive on time and in the correct amount each month.

Next Steps

Navigating SSI state supplements in California can feel overwhelming, especially when your financial stability depends on receiving the full monthly benefit. Understanding the eligibility requirements, gathering documents early, and applying correctly can help you avoid missed payments and protect your income.

Filing early and reporting changes promptly ensures your benefits reflect your actual situation and arrive on time each month. The proper support can simplify the process, reduce stress, and give you peace of mind knowing you are not leaving money on the table.