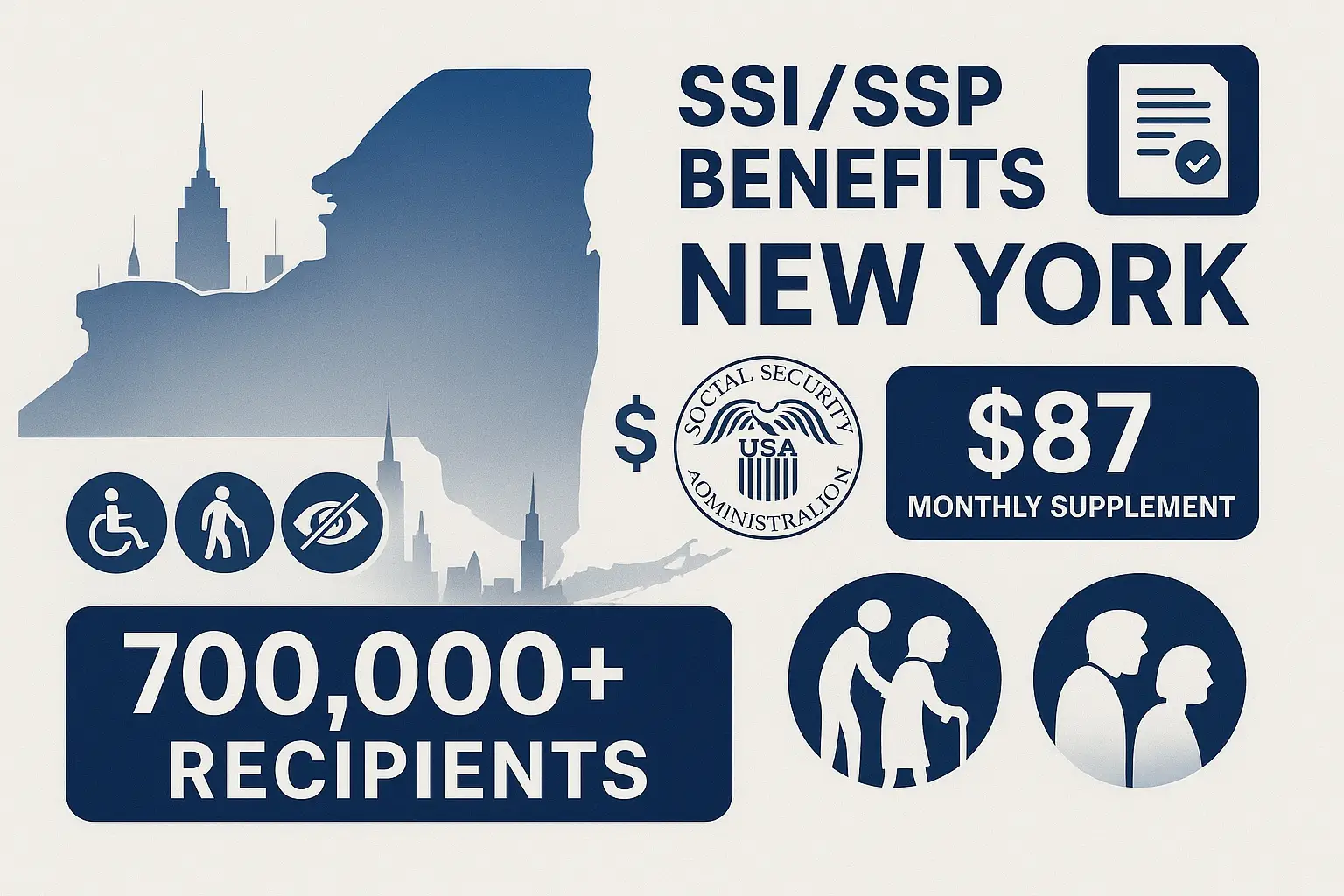

Over 700,000 New York residents rely on Supplemental Security Income (SSI) monthly to cover essential needs like food, shelter, and medical expenses. SSI benefits can make the difference between stability and financial hardship for individuals with limited income and resources. New York goes a step further by offering SSI state supplements through the State Supplementary Payment (SSP) program, which is designed to offset the state’s higher cost of living.

Understanding these benefits is critical. The Social Security Administration (SSA) and the New York State Office of Temporary and Disability Assistance (OTDA) work together to ensure eligible individuals receive the correct monthly benefit. Your living arrangements, income, and even small changes in household status directly impact your benefit amount. Missing a reporting deadline or submitting incomplete information can result in delayed payments, overpayments, or even lost eligibility.

Acting early and filing accurately is the most innovative way to secure your benefits. Electronic applications are processed faster, and timely reporting helps prevent penalties or payment gaps. Whether you’re applying for SSI for the first time or already receiving federal SSI benefits, knowing how the New York state supplement program works can help you protect your income, avoid costly mistakes, and keep your financial support consistent month after month.

What Are SSI State Supplements in New York?

Supplemental Security Income (SSI) is a federal program that provides monthly cash benefits to individuals who are blind, disabled, or age 65 and older with limited income and resources. The federal benefit rate (FBR) is set annually by the Social Security Administration (SSA) and establishes a baseline payment amount to cover basic needs like food, shelter, and clothing.

However, New York's living costs are higher than the national average. New York offers an SSI state supplement through the State Supplementary Payment (SSP) program to close that gap. This program is funded and managed by the New York State Office of Temporary and Disability Assistance (OTDA) in partnership with SSA.

These SSI benefits ensure that individuals who meet SSI eligibility requirements receive enough financial support to maintain a minimum standard of living. These state-funded financial assistance payments are automatically added to your federal SSI benefit, so you receive one combined monthly benefit paid directly to you. This additional supplemental income helps cover basic living expenses, particularly for people in higher-cost living arrangements like adult care facilities or congregate care homes.

Who Qualifies for SSI State Supplements in New York

To receive SSI state supplements in New York, you must first qualify for federal SSI benefits. Eligibility is determined by the Social Security Administration (SSA) and considers your age, disability status, income, and resources. Once approved for SSI, New York automatically reviews your case to determine if you qualify for the state supplement.

Federal SSI Eligibility Basics

The federal government sets clear rules for who can receive SSI:

- Age or Disability: You must be age 65 or older, legally blind, or have a physical or mental impairment that prevents you from working and is expected to last at least one year or result in death.

- Income and Resources: Your countable income must be below the federal benefit rate, and your resources cannot exceed $2,000 for a single person or $3,000 for a couple. Resources include bank accounts, cash, and certain assets, excluding your home and vehicle.

- Citizenship Requirements: You must be a U.S. citizen or a qualified alien who meets SSA residency rules.

New York State-Specific Requirements

Even if you qualify for SSI federally, you must also meet New York’s requirements:

- Residence: You must live in New York State and maintain this residence.

- Living Arrangement: You must live in an eligible setting, such as independent living, shared housing, an adult care facility, or a congregate care home.

- Reporting Requirements: You must promptly report any changes in address, household members, or income. Failure to report can result in overpayments or suspended benefits.

Meeting these criteria ensures you receive the correct monthly benefit amount and avoid gaps in your cash benefits.

Living Arrangement Categories and Monthly Benefit Amounts

Your living arrangement is one of the most essential factors the Social Security Administration (SSA) and New York State use to determine your monthly benefit amount. Understanding which category you fall into ensures you receive the full amount you are entitled to and avoid costly errors.

Independent and Shared Living

If you live in your own home or apartment, you are considered to be living independently. For 2024, individuals in this category receive an additional $87 per month on top of their federal SSI benefits, while couples receive $128. If you share household expenses with another person, you may fall under shared living. In this case, the state supplement is lower: $29 per month for individuals and $43 per month for couples.

Adult Care Facility and Congregate Care

Recipients who live in licensed adult care facilities or group living situations may receive higher SSI benefits, as their living expenses are typically greater. The amount varies depending on the facility type and level of care needed. These supplements are designed to ensure that disabled individuals, seniors, and those with severe functional limitations can cover basic needs like shelter, food, and supervision.

Comparison Table 1 – Monthly Benefit Amounts by Living Arrangement

Accurately reporting your living arrangements is critical. If you move or your household changes, report it to SSA within 10 days to prevent overpayment or a sudden reduction in your monthly benefit paid. This simple step helps keep your cash benefits consistent and avoids unexpected repayment notices.

How Payments Are Calculated and Delivered

Your monthly benefit is the sum of your federal SSI benefit and your New York State Supplementary Payment (SSP). Rather than receiving two separate checks, the Social Security Administration (SSA) issues one combined monthly payment. This streamlined process ensures recipients do not need to file individual applications or track multiple payments. Payments are typically issued on the first day of each month. The payment is sent on the preceding business day if the first falls on a weekend or federal holiday. Most recipients choose direct deposit, which delivers funds faster and reduces the risk of delays. Paper checks are available but may take longer to arrive—a painfully slow process compared to electronic payments.

Both federal and state benefits are subject to cost-of-living adjustments (COLA). The federal benefit rate may increase yearly based on inflation, and New York adjusts its state supplement accordingly.

Comparison Table 2 – Federal SSI vs. New York State Supplement

Failing to report income changes, living arrangements, or household members can delay your payment for months or result in overpayment notices. Prompt reporting helps protect your benefits and avoid financial stress.

Impact on Medicaid and Other Benefits

One of the most valuable advantages of receiving SSI state supplements in New York is automatic eligibility for Medicaid. Medicaid helps cover doctor visits, hospital stays, prescription medications, and other essential medical services. This coverage begins as soon as you start receiving federal SSI benefits and continues as long as you remain eligible.

In addition to Medicaid, SSI recipients may qualify for other state-funded programs that reduce household expenses:

- SNAP (Supplemental Nutrition Assistance Program): Provides monthly funds for food, helping you meet basic nutritional needs.

- HEAP (Home Energy Assistance Program): This program offers seasonal assistance with heating or cooling costs, protecting households during extreme weather.

- Housing Assistance Programs: These programs may provide rental subsidies or priority placement for affordable housing, especially for seniors and disabled individuals.

These programs can significantly lower your cost of living and make your monthly SSI benefit go further. To avoid losing eligibility, promptly report any income changes or household updates to the Social Security Administration and local agencies. Maintaining accurate records ensures continued access to these critical programs.

Common Mistakes and How to Avoid Them

Even minor errors can disrupt your SSI state supplements in New York, leading to stressful delays or overpayment notices. Understanding the common mistakes helps you stay compliant and secure your monthly benefit.

- Failing to Report Changes: One of the most significant issues is not reporting changes in address, living arrangements, or household members within 10 days. These changes directly affect your benefit amount. If unreported, you may be overpaid and required to return funds—a financial burden for anyone living on a fixed income.

- Misunderstanding Living Arrangement Categories: Incorrectly classifying your living situation can result in underpayment or overpayment. For example, shared housing vs. independent living categories carry different monthly benefit amounts. Double-check your category with SSA or OTDA to ensure accuracy.

- Missing SSA or OTDA Notices: If SSA requests verification documents (such as proof of residence or income), failing to respond quickly can lead to suspension of benefits. Keep your contact information updated so you receive all communications on time.

- Paper Filing and Delayed Submissions: Submitting paperwork by mail can delay processing by weeks. Use electronic filing and direct deposit to keep payments consistent and avoid unnecessary waiting periods.

Being proactive about reporting and recordkeeping is the easiest way to protect your cash benefits and avoid costly interruptions.

How to Get Help with SSI State Supplements

Navigating SSI state supplements in New York can feel overwhelming, but you don’t have to do it alone. Suppose you’re applying for the first time. In that case, you can submit your application for federal SSI benefits online at SSA.gov, by calling the Social Security Administration (SSA) at 1-800-772-1213, or by visiting your local Social Security office. When you apply, indicate your New York residency, so your eligibility for the state supplement is automatically reviewed. For questions specifically about state-funded financial assistance, the New York State Office of Temporary and Disability Assistance (OTDA) can provide information about living arrangement categories and current payment levels.

If you have already received SSI but believe your benefit amount is incorrect, you can request a review of your case. You have the right to appeal any decisions that affect your SSI benefits. Getting expert help can save you time and prevent errors that delay payments. A benefits professional can guide you through documentation requirements, income reporting, and appeals to keep your payments consistent and on time.