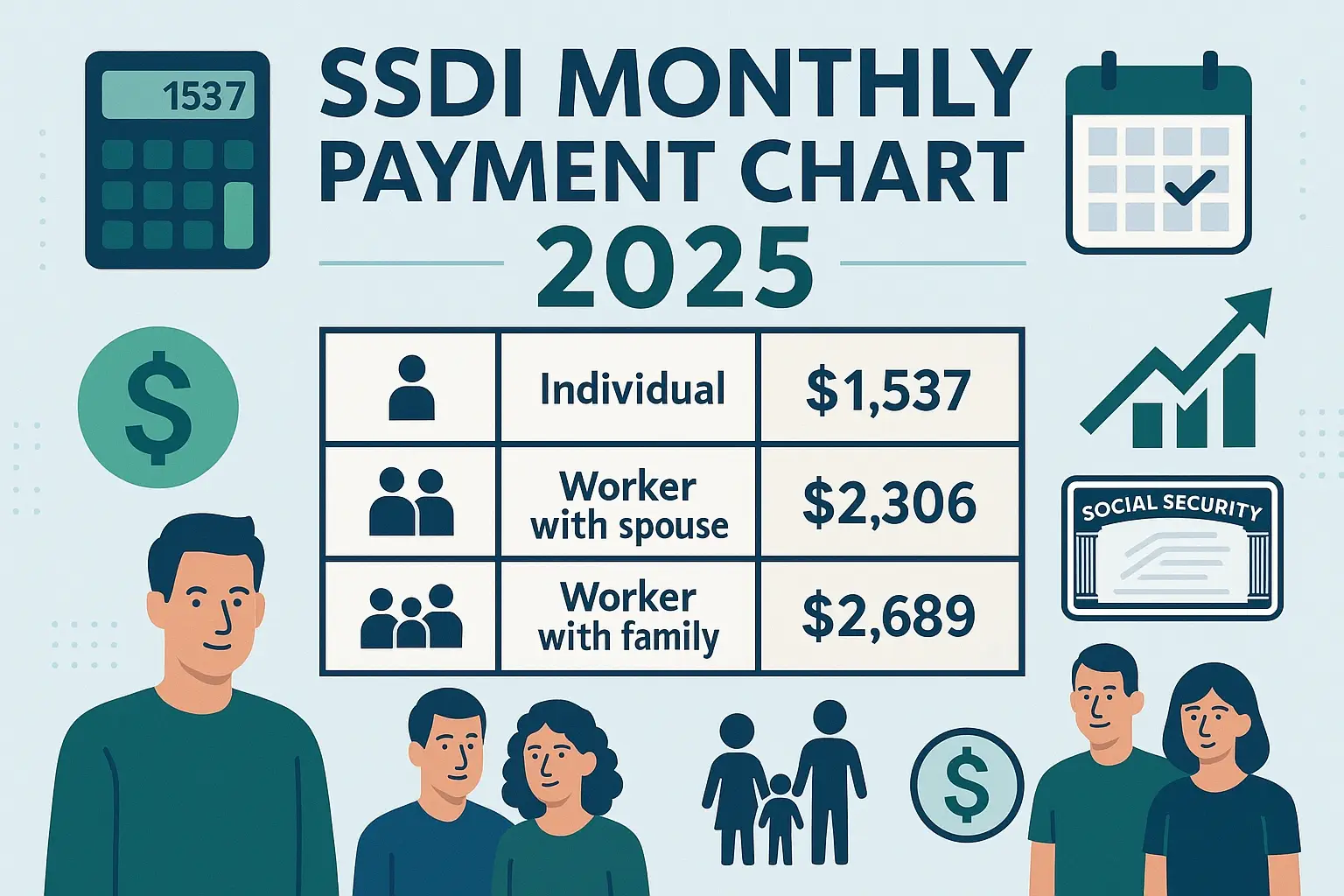

Social Security Disability Insurance (SSDI) provides monthly benefits to workers who can no longer work due to severe medical conditions. Unlike Supplemental Security Income (SSI), SSDI is based on your payroll or self-employment tax contributions. These benefits act as a financial safety net for eligible workers and their families. Without this program, many households would struggle to cover basic living expenses during a long-term disability.

Eligibility for SSDI requires proof of a qualifying disability and a verified history of past employment with Social Security contributions. Missing work credits or documentation often leads to delayed claims or outright denials from the Social Security Administration. These delays may result in lost income and increased financial stress for families. For individuals, the absence of benefits can mean choosing between medical treatment and daily necessities.

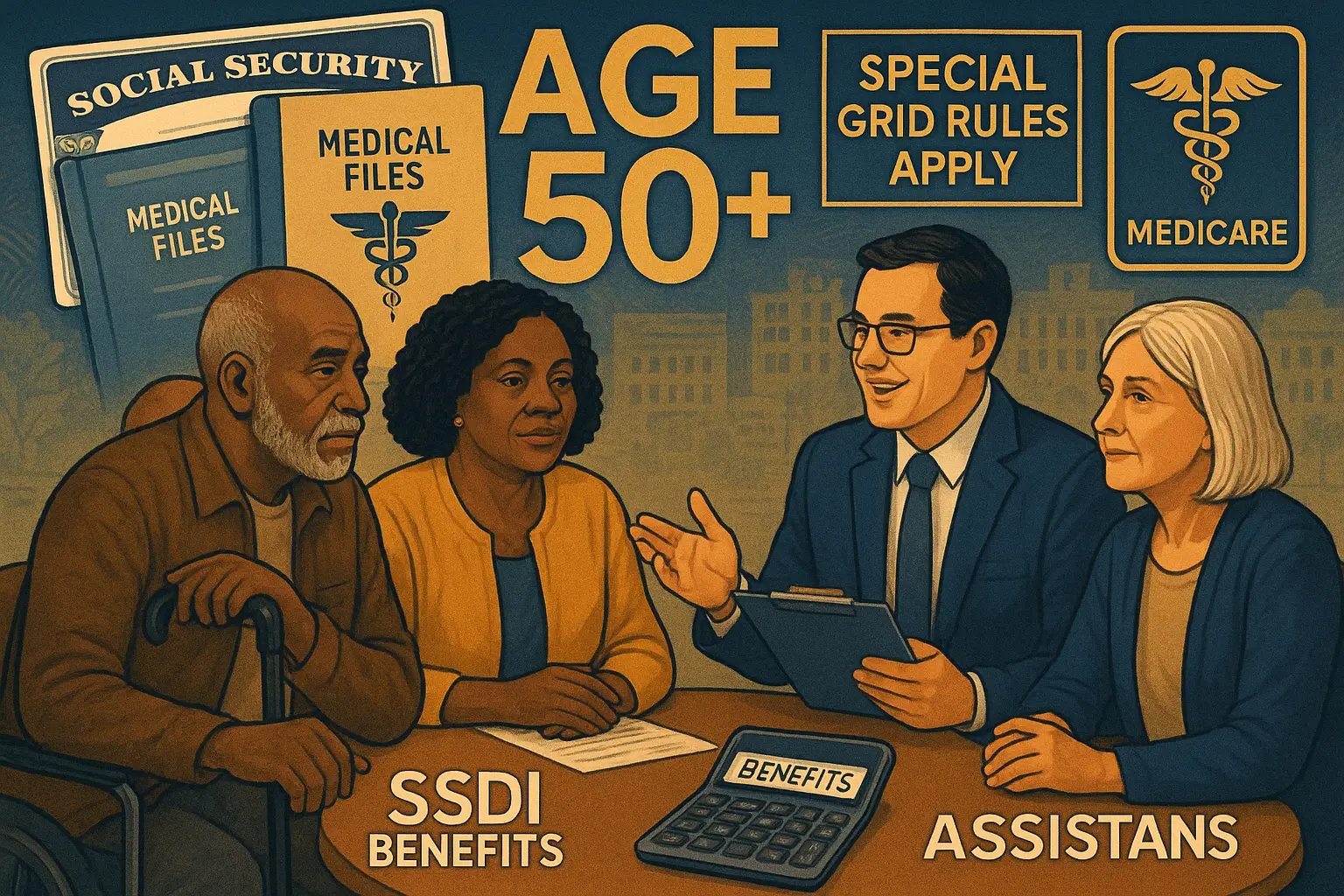

Small business owners face unique challenges when navigating SSDI requirements for themselves or their employees. An incorrect understanding of eligibility rules may disrupt financial planning and employee support. Denied claims can leave business owners without crucial income during extended disability. Learning how Social Security rules apply ensures greater financial security for both workers and entrepreneurs.

Understanding SSDI Work History Requirements

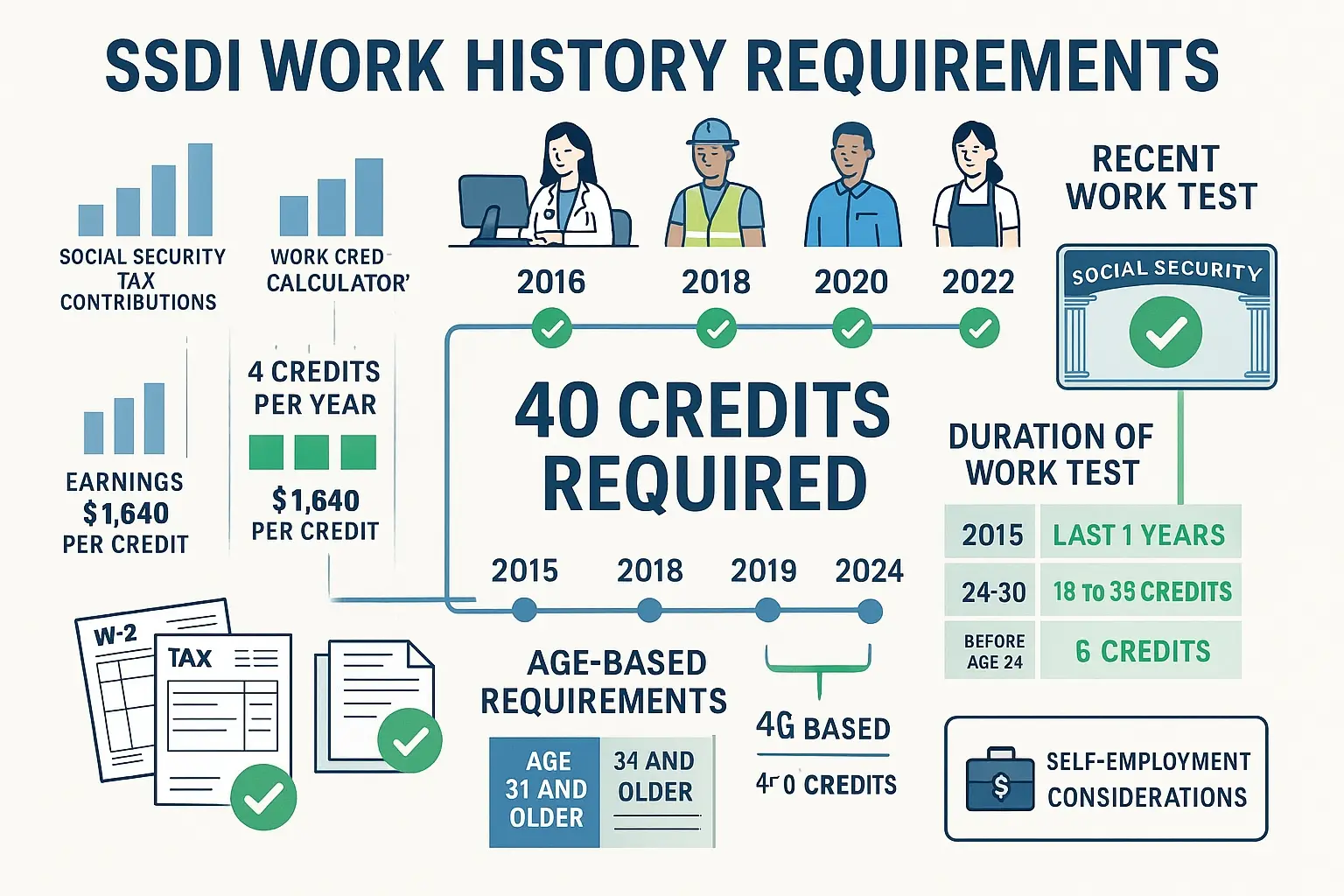

Social Security Disability Insurance (SSDI) connects eligibility directly to your work history and the Social Security taxes you paid. To qualify, you must earn enough work credits during your working years under the Social Security Act. You can earn up to four credits yearly, depending on your income level. Most people may qualify with credits gained within the last ten years before the disability began.

The Social Security Administration applies strict definition tests to verify SSDI eligibility for disability benefits. These include the recent work test and the duration of the work test, as well as measuring contributions and insured status. Even with a qualifying disability or being legally blind, you must still show enough work credits. Without them, your SSDI application may be denied, delaying critical support for you and your family.

Failing to meet these requirements affects not only Social Security Disability benefits but also possible survivors' and retirement benefits. For example, workers with limited income or irregular past jobs may lack sufficient credits to remain fully insured. Ignoring these rules can make you unable to receive support, despite a medical condition that prevents substantial gainful activity. Understanding your job skills, credits, and past work ensures proper access to SSDI benefits when you become disabled.

Types of SSDI Work History Requirements

Understanding the types of SSDI work history requirements is essential because the Social Security Administration measures eligibility using strict rules. Below are the main categories determining whether you may be eligible for SSDI benefits from Social Security Disability Insurance.

- Work Credit System: Workers earn up to four credits yearly based on income from covered jobs or self-employment. One credit equals a certain amount of paid Social Security taxes; most people need 40 credits to qualify. Younger workers with fewer working years may be eligible with fewer than 40 credits. Meeting these thresholds proves insured status under the Social Security Act.

- Recent Work Test: This test ensures your work history is close to when your disability began or started. Before age 24, you generally need six credits earned in the three years before becoming disabled. Ages 24 through 31 require credits for half the years since age 21. Age 31 or older requires 20 credits in the last ten years of past work.

- Duration of Work Test: This requirement measures the total time you worked and paid Social Security taxes. A younger worker may qualify with fewer credits, while older workers typically need 40 credits. The credits required depend on your age when the medical condition resulted in the inability to perform substantial gainful activity. In most cases, a fully insured status ensures access to SSDI benefits.

- Special Situations: Special rules may apply for military service, family members, or those legally blind with limited income. Adult children disabled before age 22 may be eligible for Social Security disability benefits based on a parent’s past job. Under certain circumstances, workers' compensation or survivors' benefits can also interact with SSDI eligibility. Self-employed individuals must pay self-employment tax to earn credits under Social Security Disability Insurance (SSDI).

In conclusion, understanding the Social Security disability benefits application process requires knowledge of all the following: work credits, recent work, and duration tests. These rules ensure that Social Security Disability Insurance SSDI supports workers who paid Social Security taxes and contributed through their working years.

Why Addressing SSDI Work History May Be Your Best Option

Meeting Social Security Disability Insurance SSDI work history requirements increases your chances of approval under the Social Security Administration’s strict definition. Properly recorded work credits ensure you receive SSDI benefits when a qualifying disability limits your ability to work. These disability benefits can extend to family members who depend on your income for support. Addressing work history early prevents gaps that may leave you unable to qualify for security disability insurance SSDI.

For workers nearing full retirement age, verifying credits protects both Social Security disability benefits and future Social Security retirement benefits. Self-employed individuals must confirm they paid Social Security taxes to secure insured status for their SSDI application. Ignoring work history risks lengthy appeals and potential loss of benefits that most people cannot afford. By addressing past work and credits needed, you ensure financial stability despite disability or limited income.

Our Simple 4-Step Process

Our simple four-step process makes applying for Social Security Disability Insurance (SSDI) easier and helps you avoid costly mistakes. Each stage ensures your SSDI application meets Social Security Administration requirements and protects your access to disability benefits.

- Case Assessment: We review your past work, qualifying disability, and paid Social Security taxes to determine your SSDI eligibility. We analyze your work credits, job skills, and medical condition against the Social Security Act’s strict definition. This step helps identify any risks that may affect your insured status. It also ensures family members understand potential survivors' benefits and disability coverage.

- Eligibility & Needs Analysis: We match your earned credits with Social Security rules, including recent work and duration of work tests. Our analysis confirms if you have enough work credits for SSDI benefits. We also review special rules for self-employment, limited income, or those who are legally blind. This guarantees you may be eligible under the Social Security disability program.

- Document Preparation & Filing: We collect W-2s, tax returns, and employer records to verify your Social Security contributions. We complete all SSA forms required in the SSDI application process. This ensures your documents meet compliance standards and avoid unnecessary denials. Proper filing protects your ability to qualify for both disability and retirement benefits.

- Ongoing Support & Updates: We monitor Social Security Administration updates regarding your case. We provide support with appeals, deadlines, and claim updates throughout the period ending. Our team also helps family members manage related SSI benefits or survivors' benefits. This continued support safeguards your financial future even if your disability started years before full retirement age.

This 4-step process simplifies your SSDI application, protects your work history, and secures essential Social Security disability benefits.