Social Security Disability Insurance helps workers who contributed through payroll taxes later face disabling medical conditions. It provides crucial monthly disability benefits that replace lost wages and reduce financial stress. Many families rely on SSDI during unexpected illness or injury. Without it, maintaining stability during long-term disability becomes extremely difficult.

The program matters because people with disabilities often struggle to cover essential expenses without a steady income. SSDI ensures housing, food, and medical costs remain manageable. It also offers long-term support when returning to work is impossible. For many households, SSDI prevents severe poverty after disability interrupts employment.

The Social Security Administration manages SSDI, linking benefits directly to a worker’s employment history. Because workers earned these protections, SSDI is not a welfare program. Delaying or ignoring eligibility can jeopardize access to critical disability benefits and Medicare health care coverage. Timely applications safeguard financial security and unlock other disability benefits for families.

Understanding SSDI

SSDI is a federal insurance program that protects workers who suffer disabling conditions after years of contributions. It replaces lost income when medical issues permanently prevent full-time employment. Providing monthly payments helps families cover daily living costs. Without SSDI, disabled workers often face devastating financial consequences.

Many workers qualify for SSDI after chronic illness or serious accidents disrupt their ability to work. Conditions like ALS and multiple sclerosis frequently force employees to stop working. These illnesses create ongoing financial strain without a safety net. SSDI ensures stability when health challenges eliminate consistent employment opportunities.

SSDI differs from Supplemental Security Income because eligibility depends on prior work history and Social Security contributions. SSI provides need-based support for low-income individuals. Some households qualify for both, combining SSI and SSDI benefits for broader protection. Delaying applications risks losing health care coverage and vital disability benefits.

Types of SSDI Benefits

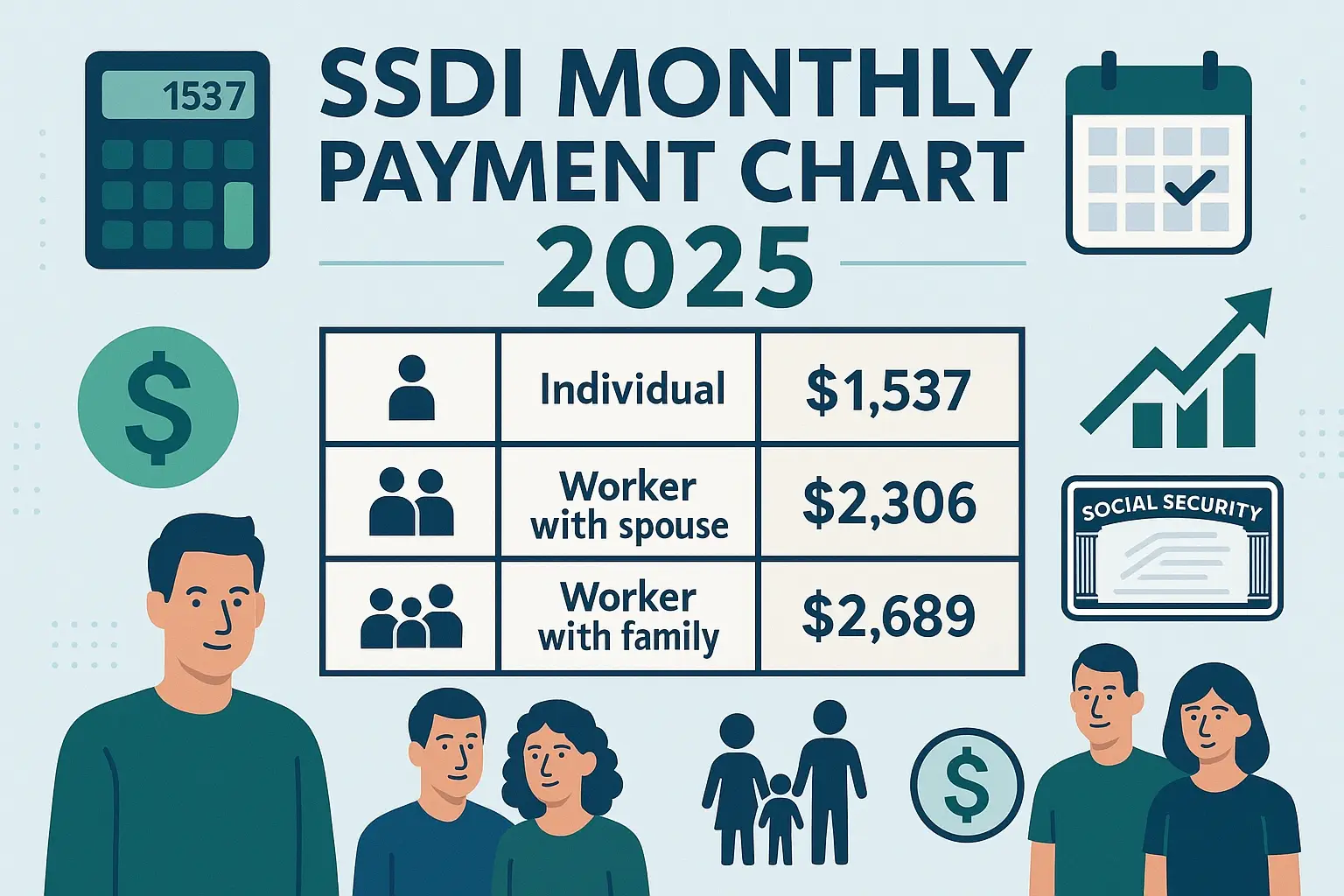

The Social Security Disability Insurance (SSDI) program is a federal program that provides disability benefits to eligible workers and their families. Different SSDI benefits exist; each addresses specific needs based on work history, family circumstances, or medical conditions. Below are the main categories explained in detail.

Standard SSDI Benefits

- Work History Requirement: Standard SSDI benefits are based on your personal work history and whether you paid Social Security taxes.

- Earnings Record: The Social Security Administration calculates monthly benefits using your lifetime wages and jobs covered by Social Security.

- Eligibility Criteria: To be eligible for disability, you must have a severe physical or mental impairment that meets the SSA’s legal definition.

- Monthly Payments: These payments help replace lost income and can transition into Social Security retirement benefits at retirement age.

Disabled Adult Child (DAC) Benefits

- Parental Record Basis: DAC benefits apply to adults with a disability that began before age 22, based on a parent’s Social Security record.

- Eligibility Criteria: The adult child must be unmarried, unable to work due to disability, and covered by Social Security disability benefits rules.

- Family Support: Parents who are retired, disabled, or deceased may enable their adult children to qualify for DAC disability benefits.

- Health Care Coverage: Eligible individuals may also receive Medicare or other programs that provide medical services.

Survivor Benefits for Disabled Spouses

- Age Requirement: Surviving spouses aged 50 to 60 may be eligible for disability benefits if they meet SSA eligibility criteria.

- Medical Conditions: The spouse must prove a qualifying physical or mental impairment that prevents substantial gainful activity.

- Work Record Connection: Benefits are tied to the deceased worker’s Social Security record, ensuring financial support continues for family members.

- Additional Benefits: Survivor benefits may include access to Medicare and other disability benefits designed to protect disabled individuals.

Special Rules for the Blind

- Higher Earnings Threshold: Blind workers can earn more wages than other disabled individuals and still qualify for Social Security disability benefits.

- Jobs Covered: Employment history in jobs covered by Social Security still determines eligibility for SSDI benefits.

- Eligibility Criteria: The Social Security Administration recognizes blindness as a unique disability with separate income limits.

- Monthly Benefits: Blind individuals may qualify for higher monthly benefits and extended access to health care coverage.

Difference Between SSDI and SSI Benefits

- Work vs. Need: SSDI is earned through work history and Social Security taxes, while Supplemental Security Income (SSI) is need-based.

- Combined Benefits: Some people with disabilities may qualify for both, resulting in SSI and SSDI benefits to maximize monthly payments.

- Countable Income: SSI considers countable income and resources, while SSDI focuses on wages and employment history.

- Other Programs: SSI benefits may also provide access to Medicaid and other programs, unlike SSDI, which leads to Medicare eligibility.

Different types of SSDI benefits allow the Social Security Administration to address unique situations faced by disabled individuals and their families. By understanding these distinctions, workers and family members can determine eligibility and secure the right disability benefits.

Why Addressing SSDI May Be Your Best Option

Addressing SSDI quickly ensures that people with disabilities receive steady monthly SSDI benefits for food, housing, and essential living expenses. These benefits protect families from financial collapse when medical conditions eliminate steady employment opportunities. Dependents and survivors may also qualify for other disability benefits under Social Security rules. Families who secure these benefits avoid serious hardship and maintain long-term stability.

Medicare health care coverage becomes available after 24 months of SSDI eligibility, reducing medical costs for disabled individuals and families. This coverage provides consistent access to essential treatments, prescriptions, and services that are often unaffordable without insurance. SSDI also prevents denials, penalties, and overpayments from the Social Security Administration by keeping claims accurate. For individuals and small businesses, SSDI supports smooth transitions to disability or retirement benefits.

Our Simple 4-Step Process

Getting approved for Social Security Disability Insurance can feel overwhelming, but our structured process makes each step clear and manageable.

- Case Assessment: We carefully evaluate your situation, review your work history, and explain how Social Security Disability Insurance or other benefits may apply.

- Eligibility & Needs Analysis: We confirm whether you meet Social Security Administration work credit requirements and determine if you also qualify for SSI benefits.

- Document Preparation & Filing: We prepare and submit all paperwork accurately to ensure your claim for disability benefits or retirement benefits is filed correctly.

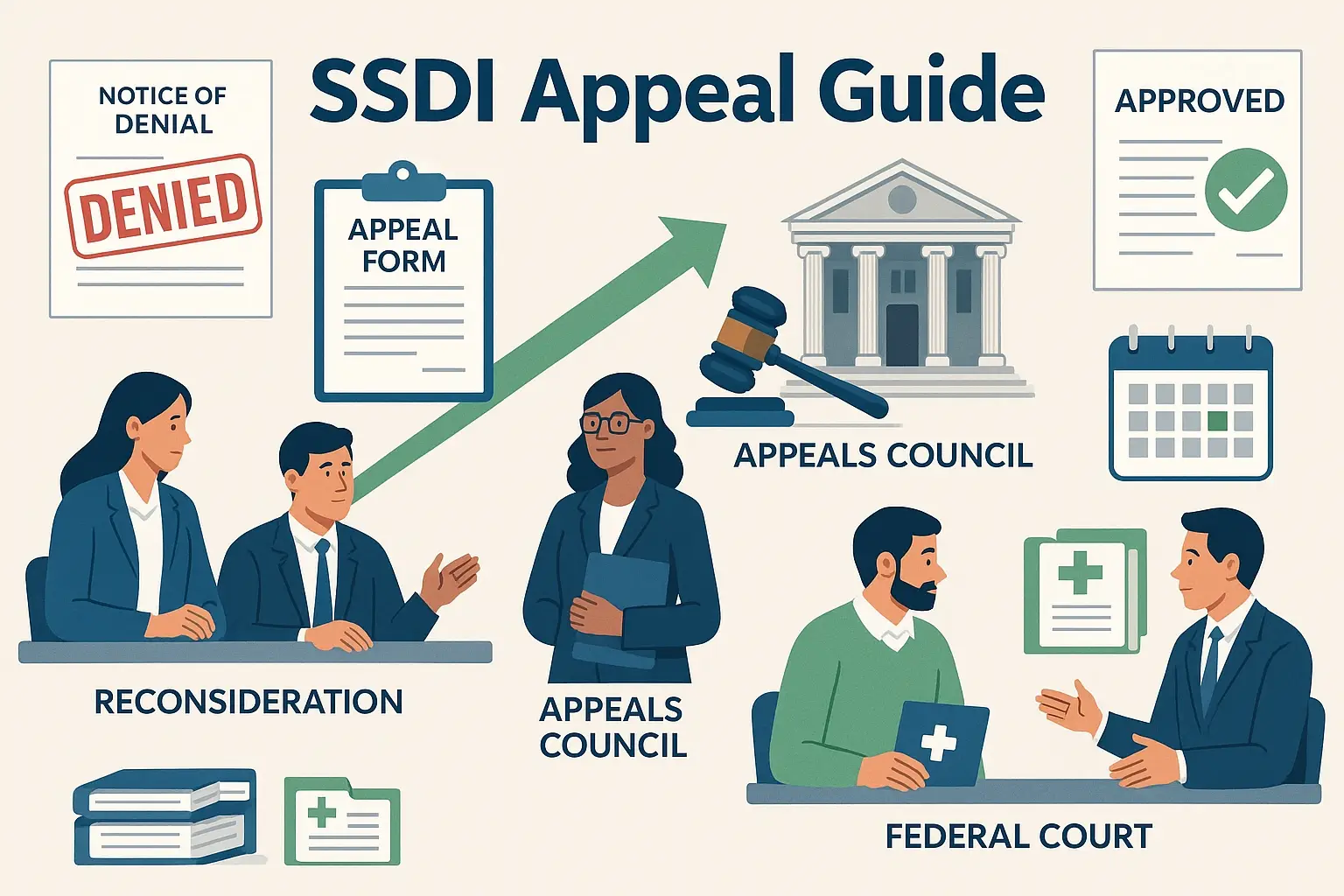

- Ongoing Support & Updates: We continue to support you by monitoring your case, guiding appeals, and ensuring access to health care coverage and other disability benefits.

This four-step approach ensures you never face the application process alone and helps you secure the disability benefits you deserve.