Social Security Disability Insurance (SSDI) offers monthly benefits to workers who can no longer maintain gainful employment. These benefits replace lost income, providing financial stability for individuals facing long-term disabilities. The amount received is based strictly on payroll tax contributions, not personal savings or financial resources. Understanding this structure ensures claimants know what support to expect during difficult transitions.

Benefit payments from Social Security depend on prior earnings and work history rather than demonstrated financial hardship. This design distinguishes SSDI from welfare programs, emphasizing earned benefits through consistent contributions. Families can use the Social Security pay chart to plan for housing, food, and healthcare. Accurate knowledge helps reduce uncertainty and supports better financial decision-making during disability.

Recognizing employee eligibility for SSDI for small businesses avoids compliance issues and ensures proper workplace adjustments. Employers must understand these programs to handle benefits and staffing responsibly. Claim delays or mistakes often result in denied applications and serious financial setbacks. Timely, accurate filing protects employees and reduces unnecessary hardship for individuals and businesses.

Understanding Social Security Disability Benefits and Payment Charts

Social Security Disability Insurance (SSDI) provides monthly benefit payments funded through paid Social Security taxes from jobs covered under the system. Security disability benefits pay depends on your average indexed monthly earnings and work history recorded by the Social Security Administration. The SSA approves applications based on disability claim reviews, ensuring applicants meet substantial gainful activity thresholds. Recipients often consult their local Social Security office to estimate their monthly SSDI benefit and available supplemental payments.

The Social Security pay chart helps beneficiaries understand how disability benefits are calculated using the same formula as Social Security retirement. Social Security benefit payments reflect primary insurance amounts derived from average covered earnings and adjusted using the consumer price index. Workers with higher average salaries typically receive a larger monthly payment, while others may also qualify for supplemental security income. SSDI and SSI benefits offer support, but SSI benefit calculations consider income and federal benefit rates.

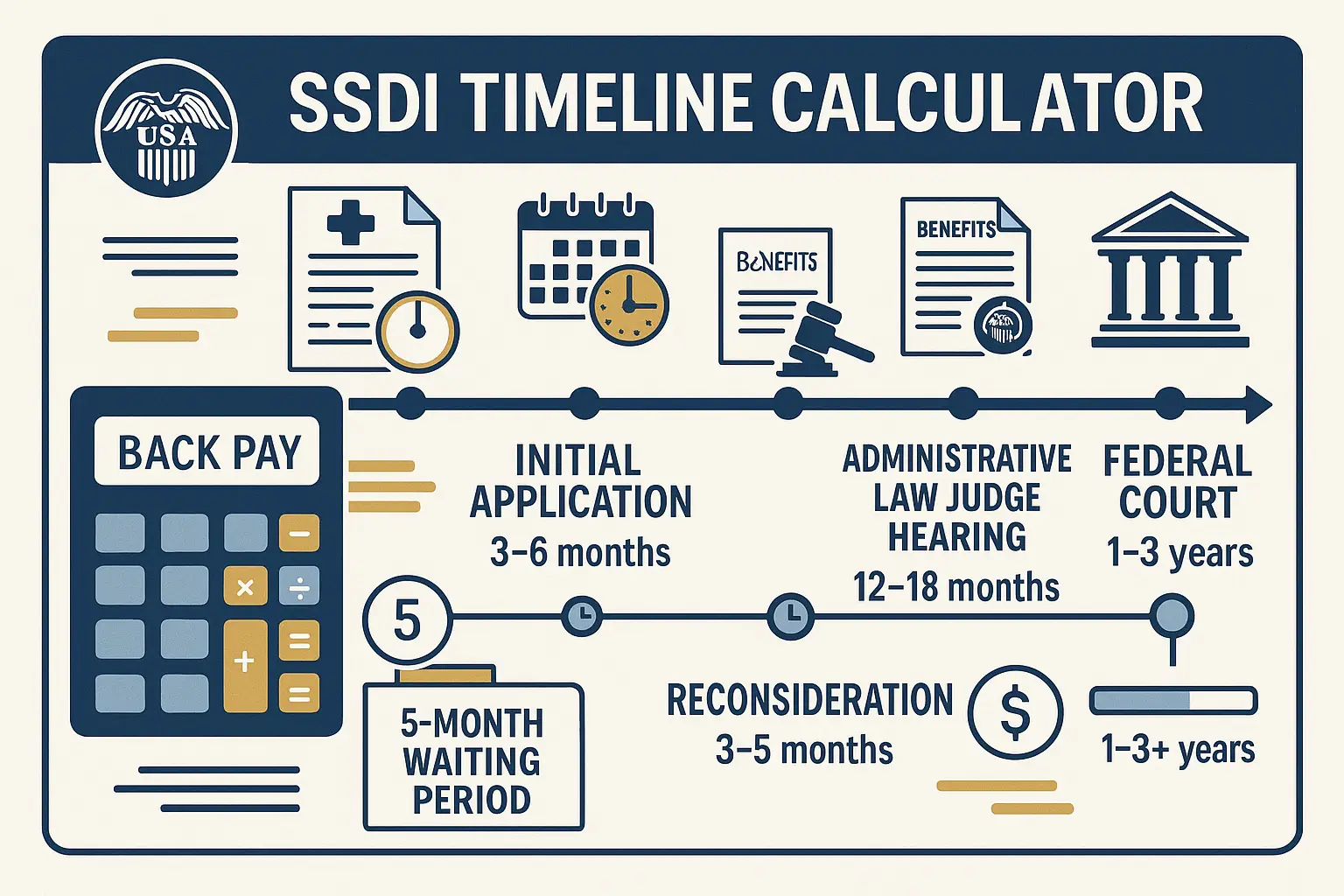

The SSDI payment schedule assigns payment days based on birthdates, usually on the third or fourth Wednesday each month. If a federal holiday occurs, the preceding business day rules ensure beneficiaries receive payments without interruption. Disability benefits pay chart updates often include cost-of-living adjustment (COLA) increases, reflecting annual amounts linked to pay increases nationwide. Beneficiaries can receive payments through direct deposit, lump sum back pay, or supplemental security income SSI when eligibility overlaps.

Types of SSDI and Disability Benefits

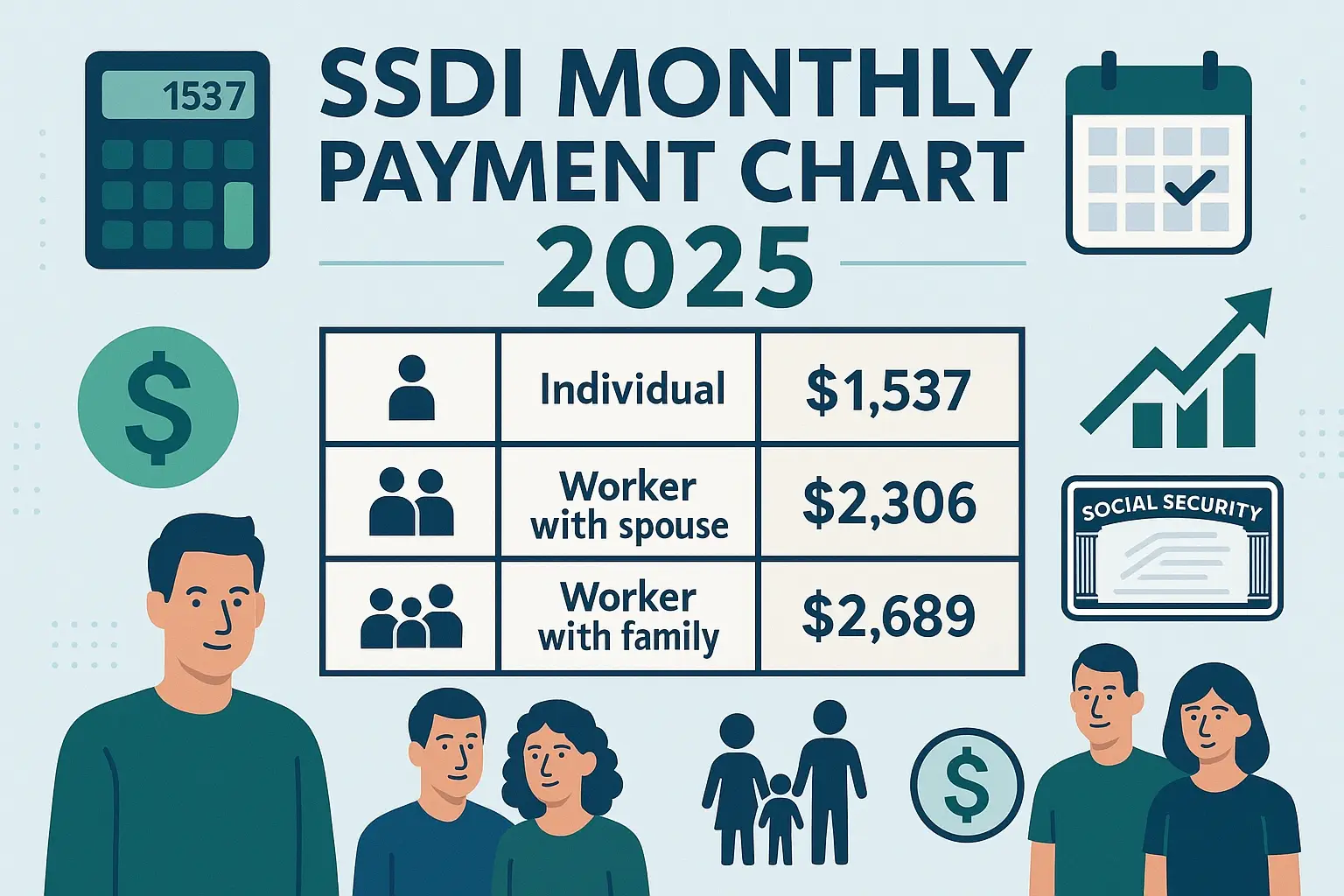

Social Security Disability Insurance (SSDI) offers different pay options depending on family circumstances, work history, and benefit eligibility. Understanding these categories helps recipients plan for financial needs and evaluate how Social Security benefit payments support their household.

- Individual Benefits: An eligible disabled worker receives monthly SSDI benefits based on average indexed monthly earnings, with 2024 payments averaging $1,537.

- Worker with Spouse: When a spouse qualifies, the monthly SSDI payment increases, with average Social Security disability benefits totaling about $2,306.

- Worker with Spouse and Children: Families receive broader coverage, with the Social Security pay chart showing average monthly benefits of $2,689 in 2024.

- Family Benefits (Auxiliary): The Social Security Administration allows spouses and children to receive up to 50% of the worker’s SSDI benefits, within limits.

- Example Scenario: A worker with a $2,000 primary insurance amount may see each dependent eligible for $1,000, capped by SSA rules.

By reviewing these SSDI and disability benefits pay options, individuals and families can better estimate monthly support and make informed financial decisions.

Why Addressing Social Security Disability Payments Matters

Addressing Social Security disability payments matters because they provide a stable source of disability benefits when work becomes impossible. These Social Security benefits protect families from depending on credit cards, loans, or unpredictable other income during financial hardship. The Social Security Administration ensures access to Medicare after 24 months, reducing costly long-term healthcare burdens for disabled workers. Monthly benefit amounts safeguard financial security while maintaining household stability through consistent SSDI payments.

Timely disability claim processing also provides Social Security disability back pay, restoring months of lost benefits for approved applicants. Small business owners and self-employed individuals who paid Social Security taxes receive protection through disability insurance coverage. Families can rely on SSDI benefits and supplemental security income when substantial gainful activity is no longer possible. Addressing these Social Security payments ensures fairness, stability, and healthcare access for all eligible workers and their families.

Our Simple 4-Step Process for Social Security Disability Benefits

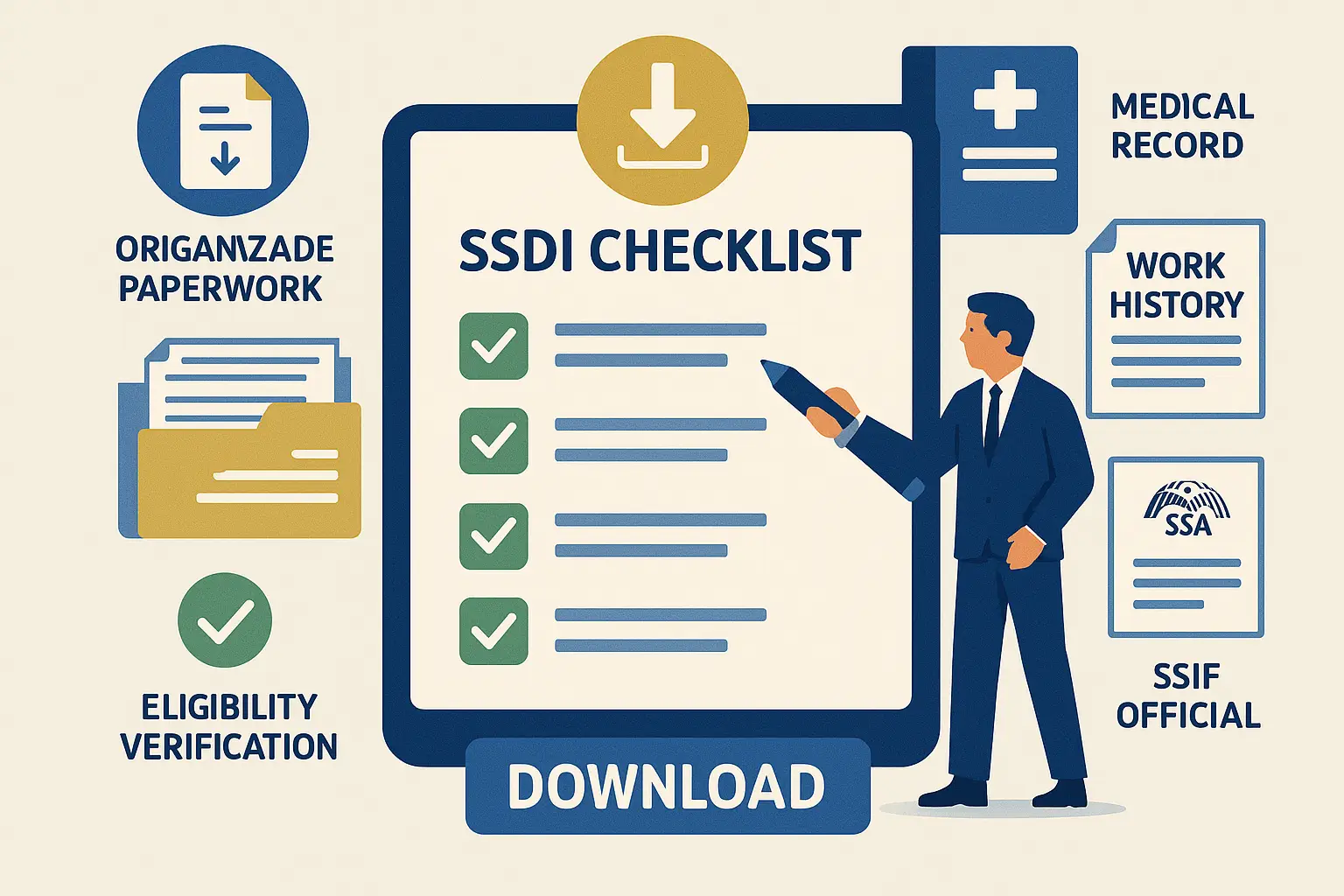

Securing Social Security disability benefits can feel overwhelming, but following a transparent process makes it manageable and less stressful. Our structured four-step approach ensures every applicant receives guidance, accuracy, and ongoing support when navigating SSDI benefits and Social Security Administration requirements.

- Free Case Assessment: We review your disability insurance situation, explain potential risks, and outline Social Security disability benefits options.

- Eligibility & Needs Analysis: We confirm whether you meet Social Security disability requirements and evaluate your needs compared to other income programs.

- Document Preparation & Filing: We gather medical records and work history, then file correctly to secure disability payments without unnecessary claim delays.

- Ongoing Support & Updates: We track claim progress, assist with appeals, and notify you about Social Security pay chart or COLA updates.

By following this four-step process, applicants gain confidence, minimize mistakes, and increase their chances of receiving timely Social Security disability benefits.